What Does the Silicon Valley Bank Collapse Mean For The Economy?

What Does the Silicon Valley Bank Collapse Mean For The Economy?

Welcome to FiveThirtyEight’s politics chat. The transcript below has been lightly edited.

amelia.td (Amelia Thomson-DeVeaux, senior reporter): On Friday, financial regulators announced that they were taking control of Silicon Valley Bank, signaling the largest bank collapse since the global financial crisis of 2008. California regulators closed the bank and put the Federal Deposit Insurance Corporation in charge of its assets. SVB was the victim of a good old-fashioned bank run, set off by a series of bad decisions last year and bad communication about those decisions.

This was — to put it mildly — a big deal for the financial sector. As of last year, SVB, which has been around since the early 1980s, was the country’s 16th largest lender. Its clients were heavily concentrated in tech, and the vast majority of its funds were uninsured, putting companies like Roku and Etsy in a vulnerable position. Then on Sunday, New York-based Signature Bank abruptly closed its doors after a similar run on deposits on Friday.

On Sunday, the Biden administration said that SVB and Signature customers will be made whole — even if their accounts exceed the $250,000 that is covered under federal law. But there’s still a lot of uncertainty about how SVB’s collapse could affect the rest of the economy — and also how the government’s intervention will be received by the public. The Biden administration has underscored that this isn’t a bailout, but it’s not clear if that’s how Americans will see it.

There is a lot to talk about here, clearly! But let’s start with the basics — what the heck is going on with SVB right now?

santul.nerkar (Santul Nerkar, editor): I think there are a number of factors at play here, Amelia. First, it is true that one proximate cause of SVB’s collapse was the Fed’s decision to raise interest rates starting last March. To raise the capital they needed to make their depositors whole, SVB was forced to sell off (among other things) U.S. Treasury bonds. The bond market is very sensitive to interest rate hikes, so the market price for bonds has plummeted, meaning that SVB sold those at a tremendous loss. Add in the fact that SVB had an unusually high number of high-risk depositors — many are not, as you mentioned, insured by the FDIC — and you have a recipe for disaster.

But obviously, to the majority of Americans, the actions of a few C-suite banking execs and federal regulators are opaque. What’s more pertinent to them is the impact on the real economy, and that is where we have a lot more uncertainty. Figures like President Biden have stressed that actions to protect depositors won’t amount to a bailout, but we’re still in the early days of this bank’s collapse and its ripple effects throughout the broader economy.

Monica Potts (Monica Potts, senior politics reporter): In fact, Biden has said that the federal government’s actions are to protect depositors, even those with deposits higher than the normal FDIC insurance limit of $250,000. Reporting has indicated that, remarkably, over 93 percent of the bank’s clients fell into that high-risk category. The bank itself did not have access to the funds necessary to cover deposits after the run on the bank began late last week, and this is exactly the kind of situation that the post-2008 crash rules were supposed to prevent. Among other things, the 2010 Dodd-Frank Act was supposed to raise capital requirements so that banks could better cover losses, and subject them to periodic “stress tests” to make sure they weren’t over-leveraged. So this will also be a question of whether the people who lived through the housing crash and the Great Recession will be happy about another bank crash and the government’s rapid response to protect the financial system.

ameliatd: Let’s talk about the potential ripple effects to the broader economy. If this is just one midsize bank that serves a niche market, why did the federal government need to swoop in? And where does the failure of Signature Bank fit in?

Monica Potts: Some people have argued that this was just the case of one weird bank taking on too much risk and having all its eggs in one sector and that the disaster would be contained. That said, the bank works with small businesses and start-ups that might have immediately had trouble paying workers and clients if the government hadn’t stepped in. Signature seemed to have been similarly invested in cryptocurrency and struggled to stay on its feet after the fallout with FTX. Bank stocks — particularly smaller banks — took a hit on Monday as a result.

santul.nerkar: Well, we already know that at least several big companies with ties to SVB have been affected significantly so how they’re able to manage their finances will be a tell. But I agree with Monica — the biggest thing I think everyone will be monitoring is how the Federal Reserve reacts. Just before SVB’s collapse, Chair Jerome Powell told the Senate Banking Committee that the institution may accelerate the rate hikes it’s been pursuing to bring down inflation even further — but this latest development has thrown all of that into chaos.

ameliatd: What would have happened if the Biden administration hadn’t stepped in the way it did? Obviously we don’t know the full counterfactual, but would have been the best-case and worst-case scenarios?

Monica Potts: I suppose the Biden administration was trying to avoid a panicked run on lots of other banks, which is why they stepped in quickly. That has more to do with vibes than anything. When people hear a bank is failing, they get nervous about their deposits and nervous about investing in banks, whether or not their situations are remotely similar to Silicon Valley Bank. That was Biden’s first message on Monday: The banking system is safe.

santul.nerkar: I think there was a very real fear that, had the government not intervened, other banks — and their depositors, workers, etc. — would be in peril as well. And that intervention is partly why some are optimistic that we’re not heading for a 2008-style type crisis. Economics commentator Noah Smith has argued that because SVB is much less connected to other banks and the rest of the economy than, say, Lehman Brothers was in 2008 — and because the government’s insurance of the deposits tells everyone else that their money is safe, we’ll avoid an industry-wide run.

But I do think it’s interesting just how coy the Biden administration has been around using the word “bailout” to describe what’s happening. He wants Americans to know that the situation is under control — while also insisting on the fairness of the process, both for depositors and for others in the real economy who remember the bank bailouts of 2008.

ameliatd: Yeah, so … is this a bailout? How is it different from what happened in 2008?

Monica Potts: In 2008, the government moved specifically to keep banks from failing, and propped them up with Treasury loans. The Biden administration has been saying that since they’re still planning on firing the heads of SVB, letting investors suffer losses, and not using taxpayer funds, it’s not a “bailout.” Nikki Haley, who’s running for the Republican nomination for president, was quick to push back on that. And on the left, Sens. Bernie Sanders and Elizabeth Warren both issued statements with a little skepticism that taxpayers wouldn’t be on the hook for some of the fallout.

santul.nerkar: It all depends on your preferred spin on things. Like Monica said, some have pointed to the fact that the bank fund that’s aiding SVB is not using taxpayer funds to argue this isn’t a bailout akin to 2008. But the fact also remains that even the fund that’s ostensibly bankrolling, well, the banks, is backed by the Treasury Department. That paints a more complicated picture than simply “not a bailout.”

ameliatd: Well, and this is the second-biggest bank failure in U.S. history! It’s kind of hard not to compare it to the 2008 crisis. So let’s talk about the politics — why have Biden and others been so quick to say this isn’t a bailout?

santul.nerkar: The last one has a really unpopular legacy! According to a 2013 Reuters/Ipsos poll, 44 percent of Americans thought the 2008 bailout was a bad idea, while only 22 percent thought it was the right move. Meanwhile, a full 53 percent of Americans thought that not enough was done to prosecute bankers. And though initial support for the bailout was moderately high, all the way back in October of 2008, those numbers quickly flipped after the bill was signed.

And then, you also have to consider how the Democratic Party has become more staunchly populist on economic issues in recent years — anchored by the success of Warren and Sanders in exerting their policy influence over the party. Calling this a bailout would not only remind Americans of the 2008 lifeboat that was thrown to Wall Street, but it would be out of step with the rhetoric and vision that Biden and Co. have set out since Day One of the 2020 Democratic primary.

Monica Potts: I think that since the Great Recession, there’s been a prevailing sense that the system protects banks but doesn’t protect people. And as Santul said, there’s lasting fallout from that. Banks were protected because they were too big to fail, but the program meant to help people modify their mortgages and stay in their homes was confusing and missed a lot of homeowners. Families lost their homes. We’re still dealing with the fallout today: Some banks are still paying the Treasury Department back, and first-time homebuyers are older and richer than ever, arguably in part because young Gen Xers and millennials took a financial hit during the crash that took years to recover from.

Add to that the protections put in place to keep banks from being in the same situation again were rolled back in 2018, under the Trump administration. At that time, Silicon Valley Bank’s CEO lobbied for less scrutiny. The argument was that slightly smaller banks like SVB weren’t as connected as the banks hit by the 2008 crash and weren’t taking on the same risks, therefore didn’t need to take part in regular stress tests like bigger banks did. And then lo and behold, once stressed they did fail and needed help because it turns out they are pretty connected to the rest of the financial system after all.

santul.nerkar: Some research has found that the behavior of banks has a lot to do with Americans’ overall trust in the financial sector writ large. A 2012 paper published in Public Opinion Quarterly found that Americans’ confidence in the banking system is driven by major bank scandals rather than events like recessions or other economic crises.

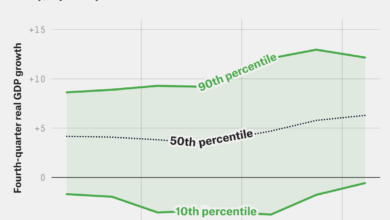

And as you can see in the following chart, Americans’ confidence in banking has dropped significantly — especially after the 2008 crisis and ensuing bank bailouts:

Monica Potts: In the meantime, Americans feel the economy helps the rich but hurts those who aren’t as well off. The Consumer Financial Protection Bureau, founded after the crash to protect individual financial consumers, is under fire and may be dismantled by the Supreme Court. And Biden’s student loan forgiveness plan is on hold and may end up getting overturned. (Again, by the Supreme Court.) As a result student borrowers, arguably the least savvy financial consumers in the country, may not get a relatively modest cut on their loan balances they were promised, while Silicon Valley companies and banks, who are supposed to know what they’re doing and manage their risks accordingly, are immediately made whole. Sen. Chris Murphy of Connecticut made that point in a tweet.

ameliatd: We’re obviously still watching to see how all of this plays out — but everyone in politics is searching for a culprit. Democrats are pointing fingers at that 2018 banking law, while a number of prominent Republicans are blaming the bank’s “woke” ideology. (I know, that one really seems like a stretch, but it’s not just Donald Trump Jr!) So do we have a sense of who’s to blame for all of this? Was it just one bank that had poor strategy and communication in a bad moment for the sector it served, and we shouldn’t read too into it? Or are there bigger lessons to be learned?

Monica Potts: I think there were likely several causes. It’s hard to argue that the 2018 law played no role, since, had SVB been subject to the Dodd-Frank regulations established in 2010, the bank might have been forced to undergo stress tests that could have hinted at its vulnerabilities. And I think it’s fair to say that the tech industry has become less popular in recent years: A Gallup poll from 2021 found that 45 percent of American adults have a negative view of the industry and 57 percent say the government should increase its regulation. This may add to the sense that Silicon Valley’s gotten out of control. That matters because tech giants and the startups funded by banks like Silicon Valley have reached into people’s lives. I can imagine discussions about increasing regulations happening soon, but I doubt anything will pass the House right now. I don’t think something exactly like this will happen again, but the ramifications could last because it fits into a longer story about tech and finance.

santul.nerkar: I agree with Monica: I don’t think there’s really one culprit at play here. Obviously, the 2018 financial deregulation — which had 17 Democrats sign on in the Senate — is going to come most under scrutiny here for how it expanded the definition of “too big to fail,” essentially making it easier for banks with assets of greater than $50 billion — but less than $250 billion — to skirt regulation. SVB, which had $209 billion in total assets when it collapsed, fit neatly into that category.

I also think we need to understand this collapse — and whatever may come as a result — within the current context of the entire economy. After March 2020, there was a well-understood desire to grease the wheels of a shut-down economy and put more money into people’s pockets. That extra stimulus certainly helped the workers and small businesses left in the lurch after people stopped using key services, but it also helped overheat the economy, which eventually led to the Fed raising rates and making SVB’s ultimate decision to pay back its depositors a risky one. All of this has led us to the current moment, in which shaky tech stocks, cryptocurrencies and other speculative assets have plummeted — signaling a potential end of the “era of cheap money.”

More broadly speaking, I think this charts an even murkier course for the Fed moving forward. The collapse of SVB is on everyone’s minds right now, so it seems natural that the Fed would move away from the faster rate increases that Powell signaled last week. All of that seems to be up in the air now, which communicates more uncertainty to consumers and another round in the waiting game for the economy’s landing.