Economists’ Best- And Worst-Case Scenarios For The Recovery Haven’t Changed Very Much

After an August jobs report that yielded better-than-expected results for American workers, economists have a much sunnier outlook on unemployment through the end of the year. But that optimism isn’t trickling into the rest of their economic forecasts — in part because there’s still so much uncertainty about what the rest of the year will bring, and in part because the July 31 expiration of the $600-per-week payment for unemployed workers could already be leaving millions of Americans in dire economic straits.

In the latest edition of our economic survey, conducted in partnership with the Initiative on Global Markets at the University of Chicago Booth School of Business, FiveThirtyEight asked 28 quantitative macroeconomic economists about the future of the U.S. GDP and unemployment numbers. We also asked them about Americans’ spending and saving habits, which the economists believe changed in August (and not for the better).

Recent jobs reports seem to have made experts a lot more optimistic about how quickly Americans can get back to work. Just two weeks ago, our survey panel thought that there was only a 29 percent chance that the unemployment rate would drop below 10 percent in the third quarter of 2020. But not only did it cross the 10 percent threshold, it fell to 8.4 percent in the Bureau of Labor Statistics’ most recent data. (Yes, there are some extenuating circumstances for that, but they don’t take too much away from the fact that jobs are recovering much faster than economists predicted.) This has caused our panel to revise their estimates for unemployment in both September and December 2020 significantly downward:

Unemployment is improving faster than expected

Predicted unemployment rates for September and December 2020, according to the FiveThirtyEight/IGM Economic Survey

| September 2020 | Forecast from… | |

|---|---|---|

| Category | Aug. 10 | Sept. 8 |

| Lower bound (10th percentile) | 8.4% | 7.1% |

| Median (50th percentile) | 10.0 | 8.1 |

| Upper bound (90th percentile) | 12.0 | 9.3 |

| December 2020 | Forecast from… | |

| Category | Aug. 10 | Sept. 8 |

| Lower bound (10th percentile) | 7.7% | 6.2% |

| Median (50th percentile) | 9.6 | 7.6 |

| Upper bound (90th percentile) | 12.7 | 9.6 |

“The surprisingly large drop in last month’s unemployment rate is seen by our survey as not being a temporary blip, but as reflecting a more permanent decline,” said Allan Timmermann, an economist at the University of California, San Diego who has been consulting with FiveThirtyEight on the survey.

The survey panel’s projected unemployment rate for December, for instance, is 2 percentage points lower now than it was when we asked just a month earlier. And our panel currently thinks there is a 63 percent chance that unemployment will drop below 8 percent at some point between now and the end of the year.

Last week’s jobs report wasn’t the first one that turned out to be a lot cheerier than most observers had projected. (Predicting the economic recovery in the middle of a pandemic is difficult, as it turns out.) Unemployment indicators have been particularly challenging to untangle because they’re pointing in a bunch of different directions — for instance, even though the unemployment rate is falling, state-level unemployment claims are still historically high.

Jonathan Wright, an economist at Johns Hopkins University who has been consulting with FiveThirtyEight on the survey, said that the survey of households that forms the basis of the unemployment rate may not be telling the whole story. That survey has a fairly restrictive definition of unemployment — it excludes some people who may be out of a job or have lost income, such as part-time workers or those not actively looking for work due to the pandemic. “Broader concepts of underemployment are still painting a rather bad picture,” Wright said.

The economists also think racial inequality in unemployment — a big problem in August’s jobs report — won’t be much better by year’s end. The survey panel predicted a median unemployment rate of 11.9 percent for Black workers in December, with at least a 90 percent chance that the year would end with a double-digit unemployment rate for that group.4 While the predicted number for Hispanic workers was slightly better (9.3 percent), the unemployment rates for both Black and Hispanic workers were predicted to be much higher than that of white workers come December. It’s extremely telling that the panel’s best case forecast for the unemployment rate of Hispanic workers (7.8 percent) is only marginally rosier than the worst case for white workers (7.9 percent), which in turn is significantly more promising than the best case for Black workers (10.1 percent).

Racial inequality in unemployment is likely to persist

Actual August 2020 and predicted December 2020 unemployment rates for American workers, by race, according to the FiveThirtyEight/IGM Economic Survey

| Dec. 2020 unemployment* | ||||

|---|---|---|---|---|

| Race of workers | Aug. 2020 unemployment | Best Case | median | Worst Case |

| White | 7.3% | 5.4% | 6.4% | 7.9% |

| Hispanic | 10.5 | 7.8 | 9.3 | 11.3 |

| Black | 13.0 | 10.1 | 11.9 | 14.0 |

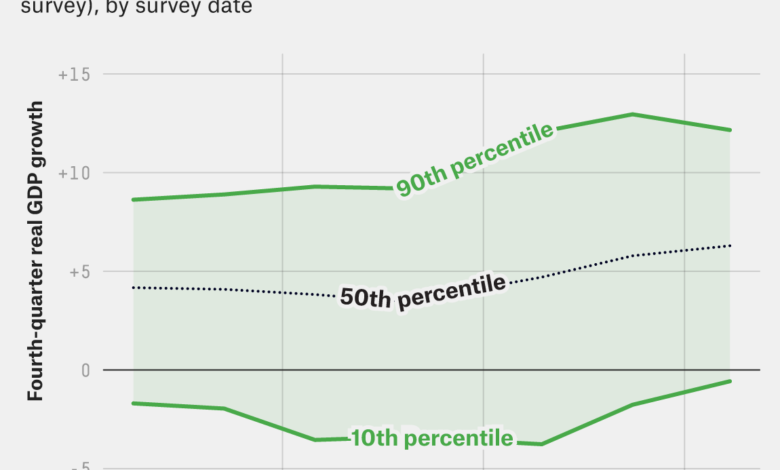

It’s also noteworthy that the economists’ optimism about the economy as a whole hasn’t really been growing — instead, there remains a huge amount of uncertainty about what will happen with economic growth over the rest of the year. The gap between best- and worst-case December real GDP growth in our survey5 is 12.7 percentage points, essentially unchanged from the estimated uncertainty in early July. Even while our survey’s forecasts for the December unemployment rate were being revised downward, the economists’ outlook for fourth-quarter real GDP growth (a much broader measure of the overall recovery) has hardly budged over the past two weeks. The panel now thinks real GDP will grow at an annualized rate of 6.3 percent (quarter-over-quarter) at year’s end, barely up from 5.8 percent on Aug. 24.

While that rate is higher than any of our survey’s median forecasts since we began asking the question on June 8, the economists still think there’s at least a 10 percent chance of negative real GDP growth in the fourth quarter — and their best-case6 forecasts have been stuck between 12 and 13 percent growth for a month now.

Another sign of the economists’ continued pessimism: They don’t think the spending and saving numbers for August will be that bullish when they come in. Despite the fact that more Americans were back on the job in August, the economists collectively thought there was a 31 percent probability that real personal consumption expenditures were substantially lower in August, compared to July, and a 51 percent chance that the personal saving rate was substantially lower in August, compared to July. Some of the economists seemed to tie their predictions for both indicators to the expiration of the $600-per-week payment for unemployed workers, which makes sense because the payment appeared to be allowing many people who were out of a job to spend more than they would normally and even save some money.

And a slowdown in consumer expenditures — or a decrease in the savings rate, which could be a harbinger of future household belt-tightening — isn’t good news for the economy, since businesses could find it harder to bring back more workers if their customers suddenly start spending less money.

All of this is to say that now is a pivotal — but confusing — moment for the economy. Things certainly aren’t as bad as the economists in our survey thought they would be a few months ago. But it’s all a matter of perspective. After all, over half the jobs that were lost in March and April still haven’t returned. And with millions of people still out of work and an enormous amount of uncertainty about the trajectory of the virus, it’s easy to understand why economists aren’t celebrating yet.