Should the Federal Government Subsidize Student Loans?

Recent debates over student loan cancellation ignore a fundamental question: should the federal government be subsidizing such loans in the first place?

The standard argument for this intervention is that, otherwise, some for whom higher ed is productive will be unable to finance such “investments” due to imperfections in private credit markets. That claim is plausible, but subsidizing such loans has negative effects as well.

Subsidizing loans can encourage excess, or the wrong kinds, of higher ed acquisition by those for whom it is not productive. This possibility is consistent with claims from some indebted students that they cannot find jobs that make use of their degrees. This is plausible, in part, because nothing ensures that loans are for training or degrees that enhance productivity.

The impact of credit market imperfections is also easily overstated. Many colleges and universities, as well as private foundations and for‐profit companies, offer scholarships, fellowships, grants, and apprenticeships to those with limited funds.

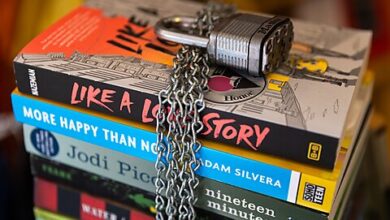

Even if the market undersupplies education loans, moreover, the federal government should play no role, instead leaving any intervention to states. Federal subsidy implies federal definition and control of higher education, which opens the door to thought control and political manipulation (e.g., via debt cancellation).

Rather than forgiving federal student debt, therefore, the right policy is to phase out such programs going forward.

This article appeared on Substack on February 28, 2024.