“Greedflation” Is an Accounting Identity Not an Economic Explanation

This week, the International Monetary Fund published a blog post and a working paper that show the contributions of profits, wages, and import prices to the recent inflationary spiral in the Euro area. While the authors note that their analysis represents an “accounting identity [which] does not allow for causal interpretation,” it has nevertheless reopened media debate on the “greedflation” theory – the idea that corporate profiteering is responsible for the post‐Covid inflation spike across the world. At least four mainstream media outlets have published articles that attribute causal interpretation to the greedflation hypothesis, using the IMF’s materials as their basis (see these articles from MarketWatch, Huffington Post, Guardian, and Telegraph).

The problem with the greedflation theory is that it is not an explanation for inflation. It is the result of an accounting exercise that simply breaks down inflation into its constituent components. It does not, and cannot, offer an explanation as to why these components are above or below their normal thresholds. Inflation is a short‐run macroeconomic variable; in that sense it is caused by shocks to the economic system that move prices away from their equilibrium values. By definition, these shocks are exogenous to the economic system and cannot be the result of greedy CEOs, scheming to take advantage of economic turmoil. Inflation has been stable for decades in most advanced economies – from the mid‐1980s till the pandemic, inflation was close to its 2% target rate. Is it reasonable to assume that corporations were greedy since Covid but were disinterested in profits at any time between 1985 and 2020?

Corporate profits are determined by price markups – the degree to which firms can charge a price that is higher than their costs. Firms cannot charge arbitrary prices. Optimal prices are set based on several market factors including demand, supply, costs, expectations, etc. As such, both cases – price increases and price decreases – may result in lost profits for a firm. Increased price markups are simply evidence of firms responding to economic conditions and reoptimizing prices.

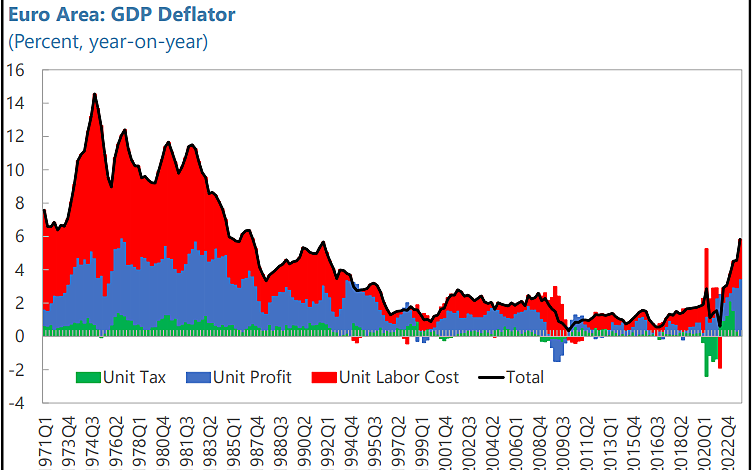

To further understand the dangers of drawing causal inference from accounting exercises, look at Figure 1 below which is a reprint, from page 9 of the IMF paper itself, of the breakdown of Euro area inflation from 1971 onwards. While corporate profits have recently become a majority factor, labor costs have historically dominated the accounting of inflation, especially during the massive inflationary spikes of the 1970s. Attributing current inflation to corporate greed is just as strange as attributing those inflation episodes to greedy workers that demand over‐inflated wages. During both cases, workers and firms were responding to shocks in the economy that temporarily increased their bargaining power in the market.

Back to current Euro inflation – the key task of an empirical economist is identifying which shocks contributed to both price markups by firms and inflation overall. To that end, the economist should use a structural framework that allows for interactions between various economic variables and shocks so that there may be some causal implications. A seminal paper from 2003 already provides a benchmark analysis that researchers could replicate or extend (I employed a similar method when breaking down inflation in the US). Drawing causal inference from accounting identities only serves to obfuscate the true story of inflation and will not allow policy makers to accurately identify the facets of the economy that will contribute the most to a full recovery.