Diamond, Dybvig, and Government Deposit Insurance

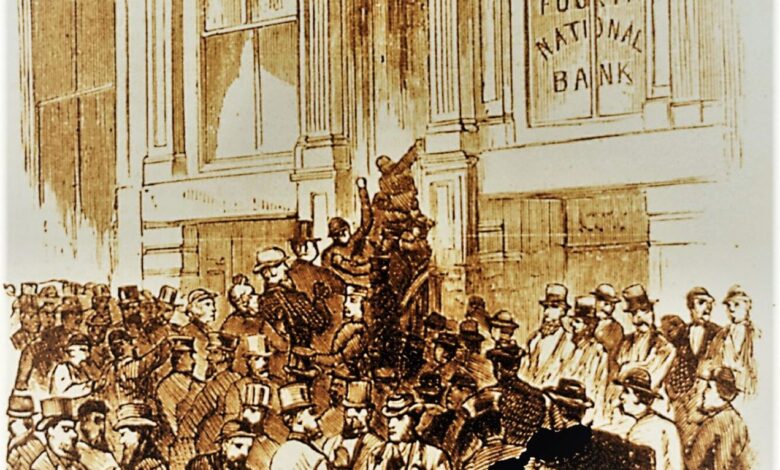

The 2022 Nobel Prize in Economics is to be shared by Ben S. Bernanke, Douglas W. Diamond, and Philip H. Dybvig, “for research on banks and financial crises.”

Diamond and Dybvig are best known for their 1983 article, “Bank Runs, Deposit Insurance, and Liquidity,” in which they claim to have shown that purely voluntary bank deposit contracts cannot achieve the optimal degree of risk sharing in a world of uncertain consumption timing, but that the optimal outcome is attainable with tax-backed deposit insurance. They conclude that “government deposit insurance can improve on the best allocations that private markets provide.” They concede that deposit insurance can give banks an incentive to take excessive risks, but argue that “in this case there is a trade-off between optimal risk sharing and proper incentives for portfolio choice.”

The Diamond-Dybvig result depends on their crucial assumption that the banking system is subject to what they call a “sequential service constraint, which specifies that a bank’s payoff to any agent can depend only on the agent’s place in line and not on future information about agents behind him in line.” In other words, the bank must settle with each depositor at the time that he or she asks to withdraw, with no later adjustments that depend on how many depositors have asked to withdraw early.

In a 1998 article, the authors have shown that Diamond and Dybvig inconsistently apply this “sequential service constraint” to the private banking system but not to their government deposit insurance agency. Without this inconsistency, there is no need for tax-backed deposit insurance in their model.

Already in 1988, Neil Wallace had considered an alternative resolution of the inconsistency inherent in Diamond and Dybvig’s “sequential service constraint”. Our paper complemented Wallace’s, by showing that with either resolution of this inconsistency, tax-backed deposit insurance is unnecessary.

This blog post provides a non-technical summary of our argument, with a few symbols but no equations. The reader is referred to the original article for the full mathematical and technical details.

The Diamond-Dybvig Model

The Diamond-Dybvig (DD) model has three periods, numbered 0, 1, and 2, and a single homogeneous good. Each agent is endowed with one unit of the good during period 0 and none in subsequent periods. All consumption is during periods 1 and 2.

There is a single production process that yields a gross return of R units of the good in period 2 for every unit of the good invested in period 0. The process may be interrupted during period 1, in which case each unit invested may be salvaged on a one-for-one basis. Once interrupted, the process may not be resumed. However, units of the good may be costlessly stored from period 1 to period 2.

All agents are identical as of period 0, so that their common period 0 expected utility is an unambiguous measure of welfare. However, during period 1, some fraction t of them will sequentially find themselves to be “type 1” agents who must consume during period 1. The remaining fraction 1–t of “type 2” agents may wait to consume during period 2, and thereby take advantage of the high rate of return R on the productive process. Whether an agent is type 1 or type 2 is not directly observable by anyone but the agent.

Given t, the optimal values c1(t) and c2(t) of period 1 consumption by type 1 agents and of period 2 consumption by type 2 agents may be found by solving the mathematical conditions for expected utility maximization. DD add the special assumptions that both R and the rate of risk aversion are sufficiently high that,

1 < c1(t) < c2(t) < R

for all values of t. These special assumptions also imply that it is less desirable to be a type 1 person than a type 2, so that there is the potential for an insurance market, in which type 2’s compensate type 1’s for their bad luck.

Left to themselves without banks or other financial intermediaries, agents would invest directly in the production process to consume either c1 = 1 in period 1 if they turned out to be type 1 or c2 = R in period 2 if they turned out to be type 2. DD correctly point out that this “autarky” solution is not optimal, since it does not maximize the initial expected utility under their special assumptions. However, it cannot be improved upon by an ordinary state-contingent insurance contract, since an agent’s “type” is non-verifiable private information.

DD then consider a “bank” that accepts a unit deposit from each agent in period 0, invests these goods in the production process, and gives depositors the option of withdrawing r1 units in period 1 or waiting until period 2. After it has made all period 1 payouts, it will distribute its remaining resources, if any, in a pro rata fashion to its remaining depositors in period 2.

If the fraction t of type 1 agents were known at the beginning of period 1, the bank could simply set r1 = c1(t) for the first t depositors who withdraw during period 1, and zero for subsequent depositors who ask to withdraw during period 1. All type 1’s will then withdraw during period 1 and obtain their optimal consumption. Type 2 agents will have no incentive to join them, since they will know they will get higher utility by waiting to period 2. Suspending redemptions after the first t withdrawals is required in order to prevent a self-fulfilling “bank run” equilibrium in which type 2 depositors, fearing a residual period 2 return r2 that is less than r1, all rush to withdraw in period 1. If the fraction f of depositors who ask to withdraw during period 1 turned out to be greater than 1/r1, the bank would entirely run out of resources in period 1 and fail, leaving the remaining type 2’s and perhaps even some type 1’s with nothing at all in either period.

The problematic case arises when t is random and is not publicly observable. If the bank pays a fixed return r1 = c1(f*) to only the first f* customers in line in period 1, after which point it suspends until period 2, it will then either be the case that f* is greater than t, in which case type 1’s receive too little, or else f* is less than t, in which case some type 1’s will not be able to withdraw when they need to. On the other hand, if the bank were to pay depositors a variable return that depended on the fraction of depositors that had withdrawn to date, then type 1 depositors who are otherwise identical would receive different returns, once again a suboptimal outcome, according to DD.

DD propose to solve this problem with what they characterize as a tax-backed government deposit insurance program. Under their system, the bank promises a fixed gross return r1 >1 to depositors who withdraw in period 1. If the fraction f of depositors who ask to withdraw funds in period 1 is greater than 1/r1, the bank fails, and the insurer pays off the remaining period 1 withdrawals. This insurance is financed with a tax on all period 1 wealth, and is levied whether or not the bank fails. Tax receipts in excess of those necessary to meet withdrawals in period 1 are turned over to the bank to be distributed in period 2 to the remaining depositors. The DD tax rate depends on the value of f that is observed at the end of period 1 in such a way that the after-tax return to period 1 withdrawers is the optimal c1(f), while that to period 2 withdrawers is c2(f), both regardless of r1. Under this DD system, type 2 depositors will always ultimately do better to wait until period 2 to ask to withdraw, so that f will equal t and the optimal risk-sharing will have been attained.

DD conclude from this that “government deposit insurance can improve on the best allocations that private markets provide.”

Our “Contingent Bonus” Contract

In fact, this conclusion derives only from DD’s inconsistent assumption that “a bank … must provide sequential service and cannot reduce [or otherwise alter] the amount of a withdrawal after it has been made,” while the deposit insurance agency is under no such obligation. It may be true that banks traditionally have offered such “sequential service,” and it may even be true that in many countries they are required to do so by regulation or even by statute. However, it is nowhere written in the laws of the “private market” that this must be the case if there is a good reason to do otherwise.

The “banks” DD describe are essentially mutual insurance companies. They attempt to provide insurance against unforeseeable contingencies at the same time that they are mutually owned, in the sense that their participants or “depositors” sooner or later receive all the proceeds from their operations. It is common for mutual life and casualty insurance companies to charge premiums up front that are based on a worst-case scenario and then later to distribute a rebate or “dividend” to their participants that is contingent on the company’s actual experience.

The “banks” in the DD model in fact promise their depositors nothing at all if they leave their money in until period 2. The return r2 they actually receive then is a function of the bank’s experience in period 1. In particular, it is a function of the value of f observed at the end of period 1. Now if depositors thus trust the bank’s management to faithfully administer the assets, to contain costs, and to calculate r2 as a function of f, there is no reason they should not trust the management to make r1 a function of f as well.

To be sure, such a bank would have to observe the final value of f before it could completely distribute this r1 for withdrawing depositors to consume. But so does the taxation authority in the DD model. In order for the DD tax to work, depositors must first state their intention to withdraw and then pay taxes before being allowed to consume, for otherwise the type 1 agents could simply consume the promised r1 and then “die” before paying their taxes, leaving behind an uncollectable tax bill. Furthermore, the DD tax must actually be collected in deposits before they are withdrawn, and not in goods, for otherwise there would be an inefficient interruption of the production process on those tax receipts that were plowed back into the bank. Thus, even though depositors learn sequentially during period 1 whether they must consume during period 1, the technology of consumption in the DD world must be such that they can wait until the very end of period 1 to actually consume.

Specifically, consider an institution whose prospectus requires it to pay depositors who announce a desire to withdraw in period 1 a total return of c1(f) by the end of period 1, and to distribute the remaining assets to the remaining depositors during period 2. This contract precisely duplicates the payoffs of the deposit contract with government deposit insurance described by DD and therefore prevents runs while achieving the unconstrained expected utility optimum.

In practice, this “bank” could unconditionally promise depositors a base payment of one unit of output per united deposited, in either period 1 or period 2, since unity is the liquidating value of the bank’s assets. Depositors demanding withdrawals in period 1 could actually be given this base payment at the time they make this demand, with the remainder, c1(f) – 1, coming at the end of period 1, as a “contingent bonus” to be determined and distributed only after the withdrawal volume is known. Such an arrangement would facilitate using at least the base value of the deposits as a payments medium. Again, the timing of this secondary distribution is no more a problem than it would be with the DD tax-backed deposit insurance program.

At the St. Louis Fed’s Symposium on Deposit Insurance on Dec. 11, 1992, Philip Dybvig raised the objection to an early draft of our paper, that in order to provide perfectly efficient insurance, our “bank” would have to have a representative clientele so that the fraction of each type of agents among its depositors is identical to that of the population as a whole. However, this is no different than the situation of an ordinary mutual life or casualty insurance company, whose pool of members may not perfectly match that of the entire population. In practice, so long as our bank or a mutual insurance company has a sufficiently large random sample of the population as its depositors or members, the law of large numbers will ensure that its experience is close enough to the population’s experience that any inefficiency will be negligible. Or, if a random sample is not feasible, a single bank could serve the entire population with this service.

The reason that the market is able to duplicate the DD government-backed insurance scheme is that their “tax” in fact does not subsidize, or even promise to subsidize, the banking sector at the expense of the nonbanking sector. In reality, all their “tax” does is make a self-financing redistribution between period 1 withdrawers and non-withdrawers; but this is something the bank could do by itself without the government’s general taxation powers.

DD claim that in their model, “Deposit insurance guarantees that the promised return will be paid to all who withdraw.” This claim is true, but only vacuously so, when we consider that their program simultaneously guarantees that the promised return will be entirely taken away as soon as it is “paid,” and replaced with something that may be completely different at the end of period 1.

Charles J. Jacklin (1993) proposed what he calls a “market rate deposit” that at the end of period 1 pays a variable dividend d that is a function of the market price p of the ex-dividend deposit itself. Since the amount agents are willing to pay for the deposit is a function of d, d and p must be determined simultaneously by the market. Although more cumbersome than our “contingent bonus contract,” Jacklin’s “market rate deposit” plan is an equivalent and prior resolution of the DD risk-sharing problem in the case of a random t.

Wallace’s Interpretation

A sequential service constraint such as DD assumed would be necessary in a world in which type 1 agents had to consume as soon as they learned they were type 1, and could not wait until the end of period 1 to consume. Since DD allow their deposit insurance agency to adjust the amount depositors receive at the very end of the period, we assumed in our paper that this is not the case.

In his 1988 paper, “Another Attempt to Explain an Illiquid Banking System: The Diamond-Dybvig Model with Sequential Service Taken Seriously,” Neil Wallace instead “takes sequential service seriously,” by assuming that sequential service is in fact necessitated by the timing of consumption.

Wallace then correctly points out that with such an immediate consumption constraint, the DD insurance scheme would no longer work, since it would be providing consumption goods to type 1 agents too late for them to use them. Wallace then shows that with immediate consumption, the optimal payout of type 1 agents is no longer constant, as DD had insisted must be the case, but rather should be a declining function of their place in line. If a bank were to make payouts according to Wallace’s schedule, it would be run-proof without deposit insurance, since type 2 agents would always do better to wait until period 2 to consume.

Our paper therefore complements Wallace’s, by showing that with either resolution of the DD inconsistency about the nature of “sequential service,” tax-based deposit insurance is unnecessary.

Conclusion

Our article showed that the potential market failure Diamond and Dybvig had modeled can easily be rectified without taxpayer-backed government deposit insurance, simply by resolving the inconsistency of their “sequential service constraint” and by instituting what we call a “contingent bonus contract.” This contract is self-financing and does not require either potential or actual taxpayer assistance. It involves no more stringent timing requirements than does the DD governmental insurance plan.

Banks and financial intermediaries serve many important functions not modeled by DD, including the clearing of payments, the transformation of loan denominations, the diversification of default risks, and the economization of information. By focusing in our article on the consumption-insurance function DD had postulated, we did not mean to imply that this is an important real-world function of banks, nor do we advocate that banks actually attempt to implement our contingent bonus contract. Our purpose was merely to lay to rest the notion that the DD model constitutes a theoretical case, as they put it, that “government deposit insurance can improve on the best allocations that private markets can provide.”

The reader is also referred to George Selgin’s far more entertaining post, “Modeling the Legend, or, the Trouble with Diamond and Dybvig, Parts I and II.” Alt-M, Dec. 17 and 18, 2020.

***

REFERENCES

Douglas W. Diamond and Philip H. Dybvig (1983): “Bank Runs, Deposit Insurance, and Liquidity,” Journal of Political Economy, 91: 401-419.

Charles J. Jacklin (1993): Market Rate Versus Fixed Rate Demand Deposits,” Journal of Monetary Economics 26: 361-384.

J. Huston McCulloch and Min-Teh Yu (1998): “Government Deposit Insurance and the Diamond-Dubvig Model.” The Geneva Papers on Risk and Insurance Theory 25 :139-149.

Neil Wallace (1988): “Another Attempt to Explain an Illiquid Banking System: The Diamond-Dybvig Model with Sequential Service Taken Seriously,” Federal Reserve Bank of Minneapolis Quarterly Review (Fall), 3-15.

The post Diamond, Dybvig, and Government Deposit Insurance appeared first on Alt-M.