The New Deal and Recovery, Part 12: Fear Itself

“This great Nation will endure as it has endured, will revive and will prosper. …[T]he only thing we have to fear is fear itself.” — FDR, in his first inaugural address.

“This great Nation will endure as it has endured, will revive and will prosper. …[T]he only thing we have to fear is fear itself.” — FDR, in his first inaugural address.

“There is no place for industry; because the fruit thereof is uncertain.”—Thomas Hobbes, on the state of nature, in Leviathan.

Not the Sum of its Parts

So far, I’ve tended to look at the New Deal as a set or sequence of distinct government policies and programs, remarking on how each either contributed to or hampered economic recovery. I’ve also dealt only with those New Deal policies generally understood to have had promoting recovery as their aim.

But the New Deal was more than just a bunch of policies. As its very name indicates, it purported to be, and in important respects it was, a novel policy regime, that is, a different overall approach to combating the depression, and to economic policy more generally.

The advent of a new policy regime, and expectations or apprehensions it inspires, can have economic consequences beyond those of any particular policies that march under its banner. Uncertainty regarding possible regime changes can also have important economic consequences.

In this and the next installment to my New Deal series, I discuss the bearing of regime change, and regime uncertainty, on the course of the recovery. As we’ll see, although the arrival of the New Deal regime had some beneficial effects beyond those attributable to any particular policies, the opposite was also true: in its later manifestations especially, the new regime proved unsettling to businessmen in ways that, according to many, prolonged the depression.

Great Expectations

That the New Deal regime change initially had positive consequences has been cogently argued by Peter Temin and Barry Wigmore. According to them, FDR

established a new macroeconomic policy regime shortly after his inauguration in March 1933. The Hoover administration had been financially conservative, adhering to the rules of the gold standard and fiscal orthodoxy. Its policy stance in the troubles of the early 1930s therefore, was decidedly deflationary. Roosevelt broke with this ideology, devaluing the dollar within 6 weeks of his inauguration, promoting fiscal expansion, and championing the virtues of inflation—reflation as he termed it.

Roosevelt’s actions, Temin and Wigmore go on to say, “marked a change in direction for government policies and for prices in general.” Unlike “isolated expansionary actions” that might be understood as “departures from what was perceived as a long-term government policy,” this change only had to be recognized by the public for that public to alter its expectations rapidly. In his 2008 elaboration on the Temin and Wigmore thesis, Gauti Eggertsson speaks of “an endogenous shift” in the public’s expectations brought about by the new administration’s willingness to set aside “policy dogmas.”

Whether the original New Deal really marked as complete a rejection of established “policy dogmas” as these authors suggest may well be doubted. For one thing, as I noted previously, FDR campaigned on a commitment to balance the budget, while assailing Hoover for not doing so. He also chose the extremely orthodox Lewis Douglas as his first budget director. Still the point remains: the benefits of the New Deal, taken as a whole, could exceed those of the sum of its parts.

Regime Uncertainty

But the opposite was also true. Even if one fully accepts the “great expectations” hypothesis, it doesn’t follow that the game-changing done by the New Deal had no dark side. The new regime’s arrival and metamorphosis over the course of the depression could also hinder recovery. In particular, Bob Higgs argues, it bred “pervasive uncertainty among investors about the security of their property rights in their capital and its prospective returns,” and this uncertainty, Higgs says, was one reason why the depression dragged on.

Although “regime uncertainty” is Higgs’s term for it, he recognizes that his hypothesis isn’t new. It had more than a few proponents during the depression years themselves, when people instead spoke of a lack of “business confidence”; and numerous economists and historians have taken it up since.

One of the idea’s early proponents was none other than John Maynard Keynes. Upon returning to England after his desultory, May 1934 visit with FDR, Keynes published an “Agenda for the President” in the New York Times and the London Times. He said in it that he saw “no likelihood that business of its own initiative will invest in durable goods of sufficient scale for many months to come.” Keynes offered several reasons for this pessimism, chief among which was the fact that “the important but intangible state of mind, which we call business confidence, is signally lacking.” And the reason for that, he said,

is to be found in the perplexity and discomfort which the business world feels from being driven so far from its accustomed moorings into unknown and uncharted waters. The business man, who may be adaptable and quick on his feet in his own particular field, is usually conservative and conventional in the larger aspects of social and economic policy. At the start he was carried away, like other people, by the prevailing enthusiasm. [But now] he is sulky and bothered; and…even begins to look back with longing to the good old days of 1932.

Keynes went on to observe that FDR could help to dispel “this atmosphere of disappointment, disillusion, and perplexity” by convincing businessmen that “they know the worst.”

As we’ll see, FDR didn’t follow this advice; and some year later, in Capitalism, Socialism, and Democracy (pp. 64-5), Joseph Schumpeter did not hesitate to blame both “the subnormal recovery” up to 1937 and the slump that followed on the “general change in the attitude of government to private enterprise” that came with the New Deal. “So extensive and rapid a change in the social scene,” Schumpeter wrote, “naturally affects productive performance for a time, and so much the most ardent New Dealer must and also can admit.

One ex-New Dealer who admitted it publicly was Raymond Moley. “Confidence,” he says in his 1939 memoir, After Seven Years,

is the existence of that mutual faith and good will which encourages enterprises to expand and take risks… And in an age of increased governmental interposition in industrial operations…the maintenance of confidence presupposes both a general understanding of the direction in which legislative and administrative changes tend and a general belief in government’s sympathetic desire to encourage the development of those investment opportunities whose successful exploitation is a sine qua non for a rising standard of living.

This, Roosevelt refused to recognize (p. 373).

“Refused to recognize” is probably not giving FDR his due. He more likely understood that a lack of business confidence discouraged investment and recovery, but chose to shake that confidence anyway to achieve reforms he considered essential either for narrowly political reasons, or because he thought they’d yield long-run social benefits exceeding their short-run costs.

Laid Low

Practically everyone agrees that inadequate investment held back the recovery. A glance at the chart below, showing percentage changes in net and gross private investment and consumption spending since the start of 1929, should suffice to drive home just how little investment there was.

The first thing that’s obvious from the chart is that, at just shy of ninety percent, the percentage decline in gross investment was much greater than the percentage decline in consumption. As a share of GDP, gross domestic private investment dropped from 16 percent to less than 2 percent.

The decline in net investment was even more severe—so much so that it turned negative and stayed that way until 1935. Although it then turned positive again, on the eve of the ’37 downturn, which saw it go below zero again, it was still 40 percent below its 1929 level. Not until 1940 would it and the other measures shown in the chart return to their original levels. For the full 1930-1940 period, net private investment added up to minus $3.1 billion. The economy’s private job-creating capacity suffered accordingly.

Yet this picture, dire as it is, doesn’t tell the full story. That’s so because the “investment” shown in it includes unplanned additions to business inventories, which tend to accompany downturns, and other short-term investments that aren’t so sensitive to perceived regime changes. For a sense of what happened to planned, longer-term investment during the depression, here’s a chart showing the course of gross private investment in all kinds of residential and business structures:

Here the inadequacy of the post-1933 recovery is still more evident than in the previous chart. Investment in structures, like overall gross private investment, first falls to a tenth of its level at the start of 1929. But at the end of the decade, after a period of slow recovery that was interrupted by the ’37 crash, it is still less than half its 1929 level.

So long as investment failed to recover, recovery writ large could only go so far, and last so long. “The depletion of capital,” Kenneth Roose observes (1954, p. 12), “limited the number of workers that could be profitably employed.” That in turn meant that such gains in consumption spending as had been achieved lacked what W. L. Crum, R. A. Gordon, and Dorothy Wescott called “sustaining momentum.” “As recovery progressed,” they wrote in assessing the 1937 collapse,

the substitution for stimulated revival of a more normally balanced expansion, predicated upon long-run undertakings by business leadership in an environment sufficiently secure from interference to justify assumption of risk, was not facilitated.

If the regime uncertainty hypothesis is right, the trouble wasn’t just that the New Deal failed to “facilitate” investment. It was that it actually discouraged it.

Guinea Pigs

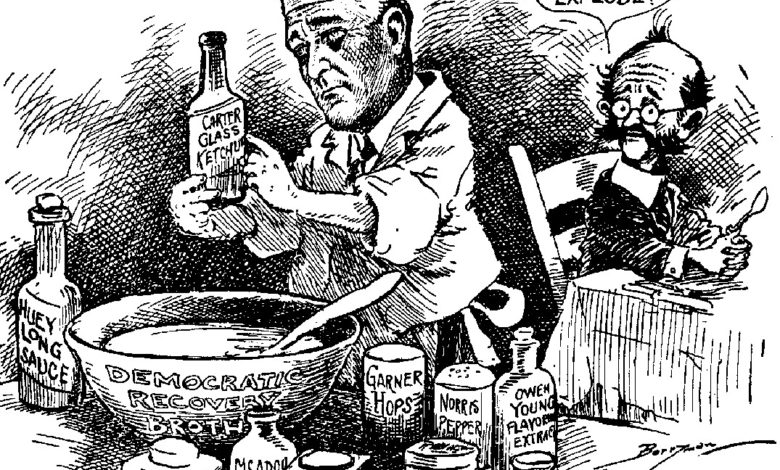

The New Deal is said to have given businessmen and investors the willies in at least two ways. First, as its policy innovations multiplied, with no apparent end in sight, and no telling what might come next, they no longer felt able to plan for the future: a long-run investment that seemed worthwhile so far might, for all they knew, cease to be so with the next new reform effort. Second, administration officials became increasingly ill-disposed toward businessmen, and big businessmen especially, to the point where those businessmen feared deliberate attempts to deprive them of their capital or already thin profits.

That the New Deal, instead of consisting of a coordinated set of previously-conceived policies, would involve trial and error, was something Roosevelt foresaw and plumped for during his 1932 presidential campaign. “The country needs and, unless I mistake its temper, the country demands bold, persistent experimentation,” he said in his famous Oglethorpe speech that May. “It is common sense to take a method and try it: If it fails, admit it frankly and try another. But above all, try something. The millions who are in want will not stand by silently forever while the things to satisfy their needs are within easy reach.”

By the fall of 1932, few could have doubted that some experimentation was called for; and that only became more obvious after the banking system collapsed on the eve of FDR’s inauguration. Nor could anyone expect every policy that was tried to succeed. But while FDR’s willingness to innovate wasn’t itself objectionable, instead of following through by assessing his administration’s experiments and discarding ones that failed, he tended, like certain WWI generals, to treat each successful offensive as a gain to be preserved at all costs, as if it were indeed part of one grand strategy.

Consequently, as the depression wore on, businessmen found themselves overwhelmed by new legislation, much of which involved considerable, if not sweeping, changes to the rules for doing business, and to their property rights. The following table, reproduced from Higgs (1997), lists only those “substantially attenuating or threatening” those rights.

The year 1935, in particular, saw such a decisive shift of the Roosevelt administration’s emphasis from recovery to reform that it amounted to an entirely new regime change—the so-called Second New Deal. By means of the “gorge of indigestible measures” enacted during it, Moley writes, the original New Deal “was completely transformed.” “The impact of these multitudinous measures,” Chase National Bank economist Benjamin Anderson wrote a decade later, “upon a bewildered industrial and financial community was extraordinarily heavy.”

And Villains

1935 also witnessed a change in the Roosevelt administration’s attitude toward businessmen.

During his 1932 campaign, Roosevelt spoke of the need for “cooperation” between the government and business; and his administration’s willingness to seek such cooperation was evident in its early conduct and policies. Even the NIRA, before the introduction of the blanket code, reflected the administration’s desire to rely upon what Moley calls “cooperative business-government planning,” and to reject the alternative of dealing with “private economic power by smashing it to bits.” Roosevelt understood, furthermore, that a lasting recovery depended on the revival of private enterprise. In short, “he had no quarrel with business, as such. Certainly he did not regard it as an enemy.”[1]

But by the summer of 1935, FDR’s disposition had changed dramatically. Riled by business organizations’ increasingly vituperative criticism of him and the New Deal; angered by the Supreme Court’s striking down of the NRA; egged-on by his Progressive advisors; and determined to win-over supporters of populist presidential candidate Huey Long by stealing a march on Long’s “Share Our Wealth” plan, Roosevelt unveiled his own plan for reining-in plutocrats—the notorious “soak-the-rich” tax proposal.[2]

FDR made the proposal in a June 19th message to Congress, “Our revenue laws,” he announced, “have operated in many ways to the unfair advantage of the few, and they have done little to prevent an unjust concentration of wealth and economic power.” His first target was inherited wealth. Calling such wealth “inconsistent with the ideals of this generation,” he recommended that, besides estate taxes, “an inheritance, succession, and legacy tax” for “all very large amounts,” as well as gift taxes to frustrate attempts to evade it.

Next came high incomes. Because “social unrest and a deepening sense of unfairness are dangers to our national life,” the Government, he said, had a duty “to restrict such incomes by very high taxes.”

The final target was big business. “Vast concentrations of capital,” FDR said, “should be ready to carry burdens commensurate with their powers and their advantages.” He therefore recommended “a corporation income tax graduated according to the size of corporation income,” to be supplemented (again as a check against evasion) by a tax on intercorporate dividends. As if this then-unprecedented proposal might not upset businessmen enough, FDR explained that he saw it as a half measure only. “Ultimately,” he said—foreshadowing legislation to come—he looked forward to both “the simplification of our corporate structures through the elimination of unnecessary holding companies” and policies that would “discourage unwieldy and unnecessary corporate surpluses.”

Roosevelt’s recommendations came as a complete surprise to Congress: in his January 3rd budget message, he’d advised against any new or additional taxes for the coming fiscal year; and deficits since then had been lower than expected. But if his new suggestions surprised Congress, they—and his corporate tax proposals in particular—threw the business community into what Ray Moley called “paroxysms of fright,” unnerving it almost as much as the Supreme Court’s striking down of the NRA had cheered it in May. Taxes were, for the first time, being proposed for the avowed purpose of redistributing wealth rather than raising revenue. The graduated corporate tax, in particular, was understood to have no purpose save the dubious one of taxing bigness.

No good purpose, that is: the Philadelphia Enquirer considered it “an effective method of hampering re-employment, preventing wage increases and delaying recovery.” Right or wrong, the Enquirer was far from alone. In its report on the Revenue Bill, the Senate Finance Committee recorded the minority opinion that the bill would be better entitled,

A bill to confiscate property; to discourage business and prevent its expansion; to destroy incentive and discriminate against ability, brain, and ambition, and enterprise; to create inequalities and to obstruct recovery; to jeopardize the financial position of the government; and for other improper purposes.

Despite such protests, the revenue bill sailed through Congress that August with unseemly haste, aided by Democratic super-majorities in both houses and congressional leaders’ desire to carry out rather than question FDR’s wishes. Although higher estate taxes took the place of FDR’s proposed inheritance and gift taxes, most of his other suggestions, including the graduated corporate tax, were enacted, if only after some watering-down. “It seems,” an article in the staid AER opined, “that such a measure is important enough to justify more deliberate and careful consideration than was given.” Instead, “all serious opposition appears to have been bought off with promises or bowled over by the huge Administration majority.”

“There can be no denying,” the AER article continued,

that the President’s message was an attack on wealth. …Nor can it be denied that the diverting of taxation from the primary purpose of raising revenue to other major purposes involves great hazards. That there are tremendous abuses that should be remedied can admit of no question. But how best eliminate the abuses and yet do a minimum of harm; how best promote ingenuity, enterprise, economy, social security and all the other desiderata becomes even more difficult with the growing complexities of modern industrial society.

It also becomes more difficult, the authors might have added, in the middle of a depression.

***

FDR’s “war” with business didn’t end with the August 20th passage of the Revenue Act. Several days later he signed another law that many businessmen found even more disconcerting. And in 1936 his rhetoric, if not his administration’s legislation, would become still more ferocious. I’ll take up the rest of the story of New Deal regime uncertainty in the next installment to this series.

Continue Reading The New Deal and Recovery:

- Intro

- Part 1: The Record

- Part 2: Inventing the New Deal

- Part 3: The Fiscal Stimulus Myth

- Part 4: FDR’s Fed

- Part 5: The Banking Crises

- Part 6: The National Banking Holiday

- Part 7: FDR and Gold

- Part 8: The NRA

- Part 8 (Supplement): The Brookings Report

- Part 9: The AAA

- Part 10: The Roosevelt Recession

- Part 11: The Roosevelt Recession, Continued

- Part 12: Fear Itself

___________________

[1] Moley, After Seven Years, pp. 184 and 300. This isn’t to say that every Roosevelt administration official showed compassion, whether real or simulated, toward businessmen. Secretary of the Interior Harold Ickes, for example, spoke contemptuously of formerly “great and powerful” businessmen, those “boastful, aggressive supermen” who now “came fearfully to Washington to beg the President to help them save some little from the disaster that by their arrogance and pride…they had themselves precipitated.” (Harold Ickes, The New Democracy, 1934, pp. 26-7).

[2] In his “secret” diary entry for November 4th, 1934, Harold Ickes notes that Roosevelt had already convinced by then, presumably by Felix Frankfurter, that “big business is bent on a deliberate policy of sabotaging the Administration.” Frankfurter had urged FDR to “recognize that there was a war on an act on that assumption,” though he added that the president needn’t “declare war verbally.” See Michael Parrish, Felix Frankfurter and His Times (1982, p. 244).

Concerning Huey Long: in April 1935, the Democratic National Committee conducted a secret poll (the questionnaire it sent around purported to have come from the National Inquirer of Washington, DC, though there was no such paper). The results suggested that, whether he ran himself or merely endorsed the Republican candidate, Long might divert enough votes from FDR to cost him the presidency, much as Theodore Roosevelt had cost Taft the presidency in 1912. See Robert Snyder, “Huey Long and the Presidential Election of 1936” (1975).

The post The New Deal and Recovery, Part 12: Fear Itself appeared first on Alt-M.