FERC’s Order No. 1920: A Costly Shell Game

Disclaimer: I served as a staff economist at the Federal Energy Regulatory Commission from 2006 to 2013 and as a commissioner adviser from 2018 to 2020.

On Monday, the Federal Energy Regulatory Commission (FERC) issued a “watershed” new ruling addressing electricity transmission and the need to expand America’s power grid. The commission claims the new ruling, titled Order No. 1920 (a nod to FERC’s statutory roots), will cost‐effectively ensure a more reliable grid. However, if the rule is effective in getting a new wave of transmission projects built, it will be a gift to developers of solar and wind projects at the expense of consumers and taxpayers. In any case, the rule is a step away from true competition and a step toward a convoluted, partisan mess.

What Order No. 1920 Does

This new rule establishes a minimum 20‐year planning horizon for regional transmission expansion (largely to accommodate new wind and solar facilities). Despite some sugarcoating from FERC, this plan: (1) mandates that regional transmission plans socialize the cost of the most aggressive climate and renewable energy goals of some states and corporate customers at the expense of consumers and taxpayers everywhere, (2) derives from no clear authority granted by Congress, and (3) was rushed to avoid further scrutiny under the Congressional Review Act.

In other words, FERC is unlawfully supporting climate goals that Congress never approved. The need to upgrade electrical infrastructure in the United States is not controversial, but the political methods employed in this ruling are. FERC, an ostensibly independent agency tasked with ensuring reliable power at “just and reasonable” rates, goes far beyond that narrow task with this new ruling.

FERC Commissioner Mark Christie said the following about Order No. 1920 at the May 13, 2024, open meeting: “This is not about promoting reliability. This rule is a shell game designed to disguise its true agenda, which is about the money. It’s a 1,300-page vehicle to socialize the trillion‐dollar cost of the rule’s sweeping policy agenda.” For the record, the trillion‐dollar cost estimate is not hyperbole, and much of the cost is hidden in tax credits.

Is FERC Doing What Congress Can’t?

Senate Majority Leader Chuck Schumer (D‑NY) gave away the shell game. When asked about the new rule, Schumer stated, “We always had FERC in the back of our minds because it could be done without congressional Republican approval.” He added that “FERC is doing just about everything we asked,” regarding the new rules that bolster the Inflation Reduction Act (IRA). Notably, Congress was unable to subsidize transmission in the IRA by including a lucrative investment tax credit (although the IRA did offer some new grants related to transmission).

This is not the first political push for more transmission at FERC when Congress comes up short. Partisan leaders both past and present have found FERC to be an easier vehicle than Congress for enacting energy policy. Although convenient politically, this directly violates FERC’s independent and nonpolitical role. Both major parties have tried to politicize FERC—President Trump’s Department of Energy proposed a fiercely partisan rulemaking in 2017, which was unanimously rejected, and rightly so. The difference seems to be that Democrats are more effective at turning their preferred policies into FERC rules. Much like Order No. 1000, FERC’s recent rulemaking promises to socialize the cost of state and corporate decarbonization policies.

Order No. 1920 Probably Won’t Enhance Reliability or Reduce Costs

Uncertainties around Order No. 1920’s cost‐effectiveness and ultimate impact are reason enough to oppose it. With this rulemaking, FERC has again failed to address its role in the ever‐increasing cost of electricity and ever‐weakening grid reliability. Commissioner Christie said during the open meeting:

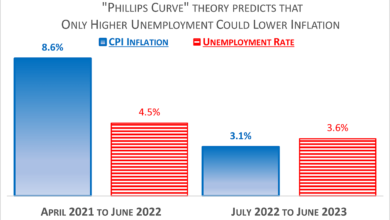

This rule could not come at a worse time for consumers. It is indisputable that power bills are rising faster than the overall inflation rate, which is itself very high. It is indisputable that transmission rates are now the fastest‐rising part of those power bills.… It’s an historic failure to stay within our legal authority. And, worst of all, it’s an historic failure to meet our basic obligations under the Federal Power Act to protect consumers.

Commissioner Christie is correct. Over the past 12 months, US electricity costs have risen 5 percent, which is nearly 2 percentage points higher than the overall Consumer Price Index. A common refrain from FERC is that the agency does not regulate retail sales of electricity—while technically true (the agency regulates wholesale markets), FERC cannot pretend its rulemakings have no impact on the cost of delivered power, especially when transmission costs continue to grow as a share of the total cost of electricity, as Commissioner Christie aptly noted.

Consumer advocates have been asking FERC to grapple with these cost impacts for years, to no avail. In other words, the commission has never understood how its rules impact the all‐in cost of electricity paid by retail customers and taxpayers, so we have no reason to believe its claims that Order No. 1920 is cost‐effective.

Further, there is no evidence that pushing the grid toward additional intermittent resources like wind and solar will enhance reliability or reduce costs. The exact opposite is more likely to be true. It is pure political propaganda to frame transmission expansion as a reliability imperative rather than a handout to developers of solar and wind projects. FERC Chairman Willie Phillips said the following in a news release:

Over the last dozen years, FERC has worked on five after‐action reports on lessons learned from extreme weather events that caused outages that cost hundreds of lives and millions of dollars. We must get beyond these after‐action reports and start planning to maintain a reliable grid that powers our entire way of life. The grid cannot wait. Our communities cannot wait. Our nation cannot wait.

Those of us who worry about grid reliability agree with the words above, but the logic is backward. As Robert Bryce has pointed out many times, if we expect extreme weather to worsen, there is no good reason to build a grid around weather‐dependent resources.

FERC is right, of course, to point out that state and federal laws mandating decarbonization and electrification are “key drivers of Long‐Term Transmission Needs.” (Paragraphs 432, 440, 442, and 481 of the final rule.) But let’s not pretend that these laws—or the FERC rulemakings that enable them—will promote grid reliability. According to the North American Electric Reliability Corporation (the reliability watchdog that reports to FERC), these policies are a growing risk to grid reliability.

Conclusion

Increasing the society‐wide cost of energy—either directly through higher electricity prices or indirectly by magnifying taxpayer‐funded IRA subsidies—is not only undesirable but goes against the mission of FERC. With this week’s rulemaking, the commission has decided to shape energy policy (which is the job of Congress, not independent agencies) rather than adhere to its mission of ensuring reliability while keeping energy costs reasonable. This naked partisanship is an argument for reducing the role of agencies like FERC in the energy sector at a minimum, optimally abolishing FERC and agencies like it, and devolving their legitimate functions to markets.

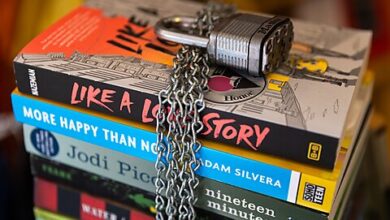

If FERC truly wanted to pay homage to the 1920s, it would not have issued a 1,363-page rule that imposes burdensome regulations. Rather, it would heed the wise words of 1920s President Calvin Coolidge in promoting the idea that “this country would not be a land of opportunity, America could not be America, if the people were shackled with government monopolies.” With this new rule, FERC adds yet another heavy chain to the shackles of government monopoly.

Cato research associate Joshua Loucks contributed to this article.