California’s Latest Audited Financials Reveal a Serious Problem

The State of California finally published its fiscal year 2022 audited financial statements on March 15, 2024, 350 days later than the March 31, 2023 deadline required by the municipal bond market and the federal government. Even worse, the tardy audit revealed that California had overstated its “Net Position” by about $29 billion.

But there was some good news. The FY 2022 filing delay of 350 days represents a slight improvement from FY 2021, reversing a trend toward worsening delays. Further, California State Controller Malia Cohen set out a goal of getting back to timely financial reporting by FY 2025. As she stated in her submittal letter attached to the newly released FY 2022 ACFR:

The SCO [State Controller’s Office] will continue to work earnestly toward the goal of publishing the 2024–25 ACFR in March 2026. The SCO’s statewide ACFR process improvement initiative will increase efficiencies and data quality to advance the fiscal integrity of the state into a position to support our continued economic growth. These efforts include establishing an ACFR compilation governance structure, streamlining manual processes, and optimizing technology. The SCO will build upon our work with partner agencies to provide departments the technical assistance and resources needed to accurately and timely submit financial reports.

While it may be a stretch to suggest that improving state financial processes is necessary to support California’s economic growth, it is good to see the state controller take ownership of the issue, which is tied to the incomplete rollout of the state’s $1 billion financial software system.

Unfortunately, the state is giving itself until 2032 to complete this software conversion, meaning we could see high‐speed rail trains rolling through the Central Valley before California’s state financial backbone is stabilized.

Information technology problems also plague the state’s Economic Development Department (EDD), which is still struggling to address pandemic‐era unemployment insurance fraud. The state auditor had to give California a qualified audit opinion because:

The Employment Development Department had inadequate internal control over its financial reporting for federally funded unemployment insurance (UI) benefits, including not properly estimating the total population of ineligible payments. As a result, the department was unable to provide complete and accurate information for certain accounts within the federally funded portion of the UI program. We were therefore unable to obtain sufficient and appropriate audit evidence to conclude that the department’s balances regarding 100 percent of Other Liabilities, 11 percent of Intergovernmental Revenues, and 12 percent of Health and Human Services Expenditures within the Federal Fund are free from material misstatement.

California is not alone in the struggle to accurately report on the financial state of its unemployment program. In her most recent analysis of state Annual Comprehensive Financial Reports for Truth in Accounting, Dr. Christine Kuglin found that Georgia, Illinois, and Nebraska also received less‐than‐clean FY 2022 audit opinions due to UI issues.

But, in terms of absolute size, California’s challenge is much larger. The Golden State government was obliged to add $29 billion of net liabilities to its balance sheet to recognize the amount of improper UI payments that may have to be remitted back to the federal government.

With the pandemic‐induced Unemployment Insurance payment fiasco now almost four years in the rearview mirror, California and other states are undoubtedly anxious to move on. The federal government might help by writing off state debts for improper payments. While that would be good for California and other state governments hoping to clean up their books, it may be less welcome by federal taxpayers who will ultimately shoulder the cost.

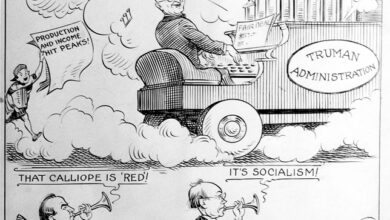

All this further illustrates a point I made in a December 2023 Wall Street Journal commentary: while Gavin Newsom’s California aspires to take on the world’s “big, hairy, audacious goals,” it remains unable to reliably tackle the less glamorous challenge of running a transparent, financially responsible government.