The New Deal and Recovery, Part 20: The Phantom Depression

It was supposed to be a debacle.

As the Second World War drew to a close, the nation’s leading economists feared that, once the armed services demobilized, at least 8 million men and women, perhaps many more, would be unemployed. That meant an unemployment rate of 12 percent—almost as high as the rate before Hitler raided the Low Countries, setting off the “wartime boom.” If their forecasts were reliable, they meant that the postwar economy could end up being no closer to recovery than the prewar economy had been.

A Worst-Case Scenario

Of course, such dire predictions weren’t unconditional. Most of those economists had a “worst case” scenario in mind—one in which, in Alvin Hansen’s words (1943, p. 5), the government chose to “just disband the Army, close down the munitions factories, stop building ships, and remove all economic controls,” without compensating for these steps by substantially increasing its spending on public works and other employment-generating programs.

But this “worst case” scenario is just what played out in fact. The government did “just disband the Army”: thanks to Operation Magic Carpet, despite the large number of military personal serving overseas, within ten months after V-J day more than 8 million of the 12.2 million military personnel on active duty that June had been discharged. By mid 1947, only 1.5 million—a million fewer than the military had planned on—were still enlisted.

And the government did close down munitions factories and other facilities that had been engaged in war production, many of which were established solely for that purpose.[1] Some ended up being demolished; others were deactivated and put on standby for the next war. The rest were cleared of wartime inventory in anticipation of their conversion to civilian uses. The government also stopped building ships: as soon as the war was over, the Navy terminated or canceled most of its ship construction contracts, and most of the shipyards established under the government’s Emergency Shipbuilding Program, including the seven large Kaiser shipyards in Richmond, California, and the Pacific Northwest, shut down.

Finally, the government quickly dispensed with most wartime price controls: those on fuels and processed foods had already been removed before Japan formally surrendered, and by the end of 1945 the Office of Price Administration (OPA) had lifted most others.[2]

As for government spending and deficits, these proved to be especially disappointing. About half of 1945 GDP had been war production, paid for by the government. Between then and 1947, defense-related federal spending fell by more than 75 percent, while (as the blue line in the FRED chart below shows) the share of GDP consisting of current federal expenditures fell by one half, from about 32 percent to about 16 percent. Finally, that year’s wartime deficit of $32 billion, instead of being replaced by a peacetime deficit of at least a third of that amount, as Keynesian economists had recommended, became a peacetime surplus of $2.5 billion (green line, right scale). These cutbacks were considerably larger than pessimistic forecasts allowed for.

The Shoe that Didn’t Drop

Yet, despite all this, there was no mass unemployment. Not according to official statistics, at least. As the next chart shows, far from returning to prewar levels, the unemployment rate never rose above 4.26 percent until 1949, and was generally between 3.5 and 4 percent—numbers comparable to, if not below, those for the Roaring ’20s. The total number of unemployed persons peaked at 2.7 million, not quite half of whom were recently returned veterans, in March 1926, and was generally closer to 2 million. These levels were well within wartime estimates of “frictional” unemployment, meaning short-term unemployment of workers seeking (and finding) jobs, rather than unemployment resulting from a lack of job openings. As such they were held to be consistent with “full” employment. Hansen, for example, had said in 1943 that, were full employment achieved after the war, between 2 and 3 million persons might still be searching for jobs at any time.

In fact, the unemployed seldom stayed so for long. In particular, the vast majority of veterans who chose to get jobs got them promptly (Modell, 1989, p. 206). That relatively few were on the market at any time during the process of demobilization was all the more remarkable in light of both the huge numbers pouring in and the fact that the 1944 Serviceman’s Readjustment (“G.I.”) Bill lowered the costs of protracted job searches by providing ex-servicemen with 52 weeks of employment compensation at the enhanced rate of $20 per week.

For contemporary testimony regarding the immediate postwar employment story, we can do no better than turn to the document that was among the first substantive fruits of the 1946 Employment Act, namely, the Economic Report of the President, published on January 8, 1947. “During 1946,” the report states,

civilian employment approached 58 million. This was the highest civilian employment this Nation has ever known—10 million more than in 1940 and several million higher than the wartime peak. If we include the military services, total employment exceeded 60 million. Unemployment, on the other hand, remained low throughout the year. At the present time it is estimated at about 2 million actively seeking work. This is probably close to the minimum unavoidable in a free economy of great mobility such as ours.

Thus, at the end of 1946, less than a year and a half after VJ-day, more than 10 million demobilized veterans and other millions of wartime workers have found employment in the swiftest and most gigantic change-over that any nation has ever made from war to peace. At its peak during 1946 aggregate employment was substantially in accord with the objectives stated by the Congress in the Employment Act.

That is, the level of employment was in accord with the objectives of that act, even though the act’s original sponsors had been certain it wouldn’t be without large peacetime deficits.

So Many Guns; So Little Butter

But employment is, ultimately, not an end in itself, but a means for procuring life’s necessities, if not its luxuries; and averting depression, as that concept is generally defined, means avoiding not just unemployment but a substantial decline in the real output of goods and services. And herein lies a mystery, for if official postwar employment numbers are ones Truman could flaunt, those for real output, seen in the following chart, tell a very different story: between 1945 and 1946, according to the most recent Commerce Department data, real GDP fell by almost a fifth, implying, in Bobb Higg’s (1999, p. 602) words, “by far the largest annual fall ever in U. S. economic history, exceeding even that of the worst year (1932) of the Great Contraction.” The monthly Industrial Production index paints an even starker picture: it was 34 percent lower in February 1946 than it had been a year before—a drop exceeding that of the entire “Great Contraction.”

Such an extreme drop in output hardly seems consistent with an economy at or near “full” employment, even allowing for a postwar decline in working hours, a temporary decline in the size of the labor force, and the “strike wave” of 1945-46. So which numbers are telling the truth? According to Higgs and several other economic historians, it’s the output numbers that bear false witness. And their arguments are compelling.

The many shortcomings of those numbers start with the BEA’s occasional revisions of its real GDP data. Every now and then, Richard Vedder and Lowell Gallaway (1991, pp. 11-12) explain, the Commerce Department’s Bureau of Economic Analysis updates the way it calculates the deflator it uses to convert nominal GNP data into constant-dollar equivalents. Since 1958, when the BEA came up with its first estimates of postwar real GNP, each of these revisions has increased the weight assigned to consumer purchases relative to government purchases in calculating the deflator, with the result that each has made the 1946 downturn look worse than the last.

If, instead of consulting the latest (1990) real GNP numbers, one consults those from 1958, one finds that, instead of losing a fifth of its value between 1945 and 1946, real GNP declines by just 7.8 percent! According to Vedder and Gallaway, and also to Hugh Rockoff (2000, pp. 86-87), the older estimate is probably closer to the truth. It’s also likely to be closer to what Edwin Nourse, Truman’s CEA chair, had in mind when he wrote the 1947 Economic Report.

Several scholars have also come up with independent measures of inflation during the 1940s, all of which tend to revise the official wartime figures upward, while revising the postwar ones downward. As Milton Friedman and Anna Schwartz explain (1982, p. 101), the government’s resort to price controls during the war, and its lifting of them afterwards, makes such revisions essential. Such controls, they say,

meant that price increases took indirect and concealed forms not recorded in the indexes. The large rise in price indexes when price control was repealed in 1946 consisted largely of an unveiling of the earlier concealed increases. Hence the recorded price indexes understate the price rise during the war and overstate the price rise after the war. This defect is reflected in the national income estimates in an overestimate of the wartime rise in income in constant prices, and hence an underestimate of the wartime rise in the implicit price index.

While the price indexes Simon Kuznets prepared for the Commerce Department after the war had prices rising by 15.6 percent between 1942 and 1945, and by about 20 percent between 1945 and 1947, Friedman and Schwartz’s revised indexes have prices rising by 27 percent during war, and by just 9 percent afterwards, implying a correspondingly reduced estimate of the depth of the postwar slump. Using somewhat different methods, Vedder and Galloway (1991, p. 10) arrive at an estimate of inflation during the immediate postwar years somewhat below Friedman and Schwartz’s, and conclude, based on it, that real GNP only fell “by a bit over seven percent” between 1945 and 1946.

Yet even such revisions, substantial as they are, fail to address the most serious shortcoming of wartime output measures, namely, their tendency to overstate, and perhaps overstate dramatically, both the nominal value of war material and the extent to which it should be considered part of national output at all. As Higgs reports (1992, pp. 45-7), Kuznets, whose wartime and postwar deflators have been called into question by Friedman and Schwartz and others, had his own grave misgivings about the Commerce Department’s valuation of wartime output. “A major war,” he observed (ibid., p. 45), “magnifies” the usual challenges involved in estimating national income, both because war materiel isn’t sold at anything resembling “market” prices, and because wars blur “the distinction between intermediate and final products.”

In light of such considerations, Kuznets came up with several unofficial, alternative measures of wartime and postwar GNP, all of which implied both a less-impressive wartime boom, or no boom at all, and no postwar slump at all. In particular, Higgs reports (ibid., p. 46), “whereas the Commerce Department’s latest estimate of real GNP drops precipitously in 1946 and remains at that low level for the rest of the decade,” Kuznets’s revised “wartime” GNP estimate “increases in 1946 by about 8 percent, then rises slightly higher during the next three years.” Another Kuznet estimate—what he called “peacetime” GNP—went still further, by valuing goods produced for military use at their nonmilitary surplus values only. In the table below, reproduced from Higg’s article, Kuznets’s “peacetime” GNP measure, labeled “Variant III,” is compared with various others. According to it, real output rose by almost 18 percent between 1945 and 1947!

More recently, Hugh Rockoff (2020, p. 38) has created a chart comparing real net national product (GNP minus depreciation) estimates by Kuznets, the Commerce Department’s Bureau of Economic Analysis (“NIPA”—for “National Income and Product Accounts”), and others, including Kuznet’s “peacetime” estimates, for both the 1930s and 1940s. The chart shows especially clearly just how unsafe it is to conclude, from the NIPA estimates, that, despite low unemployment, the U.S. economy suffered a severe slump just after World War II.

The Market’s Verdict

While the various measures of wartime and postwar output suggest that there may not have been any substantial postwar contraction, they don’t completely rule out that possibility. There is, fortunately, other evidence one can look at to decide whether the U.S. economy was depressed in 1946 or not; and it all tells the same story, to wit: that if there was a sharp postwar slump, nobody seemed to notice.

Consider the stock market. As a rule, recessions are bad for stock prices, and severe recessions or depressions have always been bad for them. During the 1920-1921, 1929-1933, 1937-1938, and 2007-9 contractions, for example, the S&P common stock index fell by 24, 79, 32, and 40 percent, respectively. Yet during the 1945 contraction it rose 18 percent. Writing in 1983, when he was teaching at Rutgers, former Bureau of Labor Statistics Commissioner Geoffrey Moore (1983, p. 147) observed that, until then, there had been only two occasions since 1873 when a business recession wasn’t associated with any decline in stock prices. One was during the very mild—and all-but-forgotten—recession of 1926-1927, which the bull market completely ignored; the other was in 1945.

Nor have things changed since Moore wrote, as is plain from the next chart (courtesy of Macrotrends), in which the orange line marks the ’45 downturn. For the whole postwar period (as of early August 2022), the average S&P 500 drop during contractions has been about 29 percent, while the median drop has been about 24 percent. In short, if there was a severe downturn during 1945, the stock market’s response to it was sui generis.

Much the same may be said about the bond market’s reaction, allowing, of course, for the fact that recessions tend to raise rather than lower bond prices, while raising bond yields. Because yields on short-term marketable securities, such as Treasury bills, tend to be most sensitive to changes in overall business conditions, these should be expected to decline most. In fact, Treasury bill yields fell during all save two of the contractions between 1919 and 1970. The exceptions were 1920-1921 and, once again, 1945 (Moore, p. 153, Table 9-4).

A final source of clues concerning the performance of the U.S. economy immediately after the war consists of contemporary magazines and newspapers, which one can search through for references to a major slump. But one will do so in vain, because there aren’t any.

****

To conclude, there was no “Great Depression” of 1945-1946. Instead of being a mere intermission in a two-act Great Depression tragedy, the war left the depression behind, ushering in a period of remarkable prosperity both in the United States and abroad that was to continue, with only relatively minor interruptions, until the 1970s. And it appeared to do so with very little help from the federal government.

The question is, how?

Continue Reading The New Deal and Recovery:

Intro

Part 1: The Record

Part 2: Inventing the New Deal

Part 3: The Fiscal Stimulus Myth

Part 4: FDR’s Fed

Part 5: The Banking Crises

Part 6: The National Banking Holiday

Part 7: FDR and Gold

Part 8: The NRA

Part 8 (Supplement): The Brookings Report

Part 9: The AAA

Part 10: The Roosevelt Recession

Part 11: The Roosevelt Recession, Continued

Part 12: Fear Itself

Part 13: Fear Itself, Continued

Part 14: Fear Itself, Concluded

Part 15: The Keynesian Myth

Part 16: The Keynesian Myth, Continued

Part 17: The Keynesian Myth, Concluded

Part 18: The Recovery, So Far

Part 19: War, and Peace

Part 20: The Phantom Depression

___________________

[1] According to Jack Stokes Ballard (1983, p. 124), aircraft, munitions, and shipbuilding firms alone employed 5.6 million workers in mid-1945, compared to just 700,000 in 1939. After the war, production in each of these industries shrank to levels that weren’t substantially higher than those before the war.

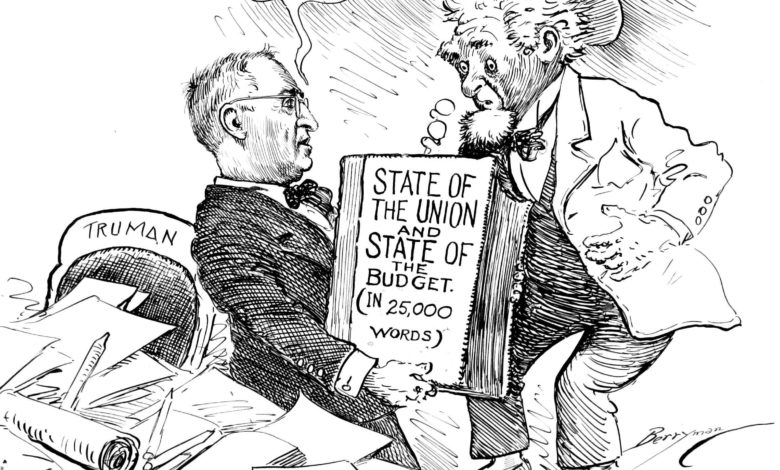

[2] After 1945 the story gets more complicated. The OPA was scheduled to shut down at the end of June, 1946. President Truman vetoed a bill that would have kept a much-weakened version of it going for another year, but only because he hoped for one that wouldn’t weaken it as much. Instead, the OPA was briefly allowed to expire, with the result that prices that had still been controlled, including those on meat, shot up rapidly. In July, another “weak” OPA bill secured Truman’s signature, allowing controls on meat prices to be reinstated. But those led to such severe shortages and consumer backlash that Truman had them lifted in October—which was not quickly enough to keep their consequences from costing the Democrats dearly in the midterms. Finally, on November 9th, 1946, Truman shut down the OPA for good, claiming that continued controls “would do the nation’s economy more harm than good.”

So much for the strictly American part of the story. Alas, what happened in the U.S. was a comedy compared to concurrent happenings in Europe and elsewhere, where the war and its aftermath led to far more severe food shortages, and U.S. authorities’ mishandling of price controls, among other blunders, impaired their capacity to stave off famine. Concerning this see Barton Bernstein (1964).

The post The New Deal and Recovery, Part 20: The Phantom Depression appeared first on Alt-M.