A green bubble refers to an over investment in renewable energy companies and technology. It is a term that has started attracting attention in the last 10-15 years because of the growing interest in alternative energy sources. Some of the related concepts include green bonds and impact/ESG investing. With the advent of the internet and social media, it is becoming more important for companies to maintain their brand image and reputation.

To do this, in recent times, companies have been allocating a portion of their funds to ESG (environmental, social, and corporate governance) related activities. A green bubble also refers to many renewable companies taking on more debt than they can handle, which pushes up interest rates. This may adversely affect the renewable energy industry by making projects more costly to finance.

There has already been a so-called ‘mini bubble’, which has taken place from 2005 to 2007, ending when the housing crisis began in the US. The bubble increased the volatility of the stock prices of renewable companies. Several factors have led to the increase in investment in the energy sector: the impact of global warming, improvement in technologies used in renewable energy (leading to lower costs and greater efficiency), and increasing awareness.

Companies are a big part of the community and have the resources to make big changes. Stakeholders are demanding that companies go beyond their profit motive and give back to society. As stated earlier, this has led companies to focus on sustainable development. Events such as the Paris Agreement (2015) and commitments made by many countries to go carbon neutral (or reduce emissions) have increased interest in the renewable sector.

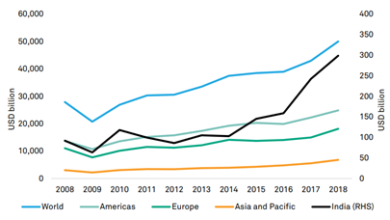

In recent years, analysts and industry experts have warned of a green bubble forming. Global funds linked to ESG activities received nearly $350 billion in 2020, compared to around $165 billion in 2019. Data from Bloomberg showed that the increased interest in alternative energy is showing itself in not just capital markets, but consumer markets as well. Companies, governments, and consumers spent more than $500 billion on renewable energy efforts and electric vehicles in 2020.

Data from Bloomberg also states that the S&P Global Clean Energy Index, which tracks the share prices of 30 renewable companies had a leading price-earnings multiple of 41 (as of Feb 2021). Its valuation has grown a lot faster than the S&P 500 index.

An example of how much of this growth may be nothing more than herd mentality is Danish power company Orsted. Over three years, it showed only modest earnings growth, yet saw its stock price nearly tripled in the same period.

A related concept related to green bubbles is the supply and demand of green bonds, which are debt instruments issued for the purpose of financing green/sustainable investments. There is a worry of ‘greenwashing’ in capital markets, which is when non sustainable investments are labelled green in order to raise finance quickly.

There needs to be transparency and effective implementation for money to be utilized efficiently. The projects must be viable because that’s how money gets transformed into results. An article indicated that the green bond market may be in somewhat of a bubble because nearly every bond issue is oversubscribed, which indicates great investor interest.

A final point to be noted is the effect of a green bubble. Global temperatures have been rising for the last century or so and this has adverse impacts on people, the environment, wildlife, and much more. Rising mean temperatures lead to rising sea levels (because of melting polar ice), more extreme weather events, disrupting wildlife, and so on. Countries have resolved to reduce emissions and work towards a sustainable environment.

A green bubble could be very beneficial to such efforts because more funds are being directed to environmental and sustainability projects, which is required. A surplus of funds directed towards R&D can only be beneficial in the long run.

On the other hand, the effect on capital markets and participants is quite different. A bubble distorts fair prices and value. Money is channeled to avenues that don’t produce the greatest value. Volatility goes up and people end up losing money when prices plummet.

Based on the evidence, it seems there is need for caution. Energy companies and funds seem to be trading at high prices despite fundamentals not justifying these valuations. There are indications of a renewable energy frenzy based on rise in prices and indices in short periods of time.

Written by- Aahan Tulshan

Edited by- Ginia Chatterjee

The post Is a Green Bubble forming? appeared first on The Economic Transcript.