Time to Jump on the Bandwagon!

Written by: Reenu

Anything that functions as a store of value and medium of exchange can be termed as money in a crude sense. The concept of money has been around for a very long time and has been in a process of continuous development making it more widely acceptable and convenient over time. The next step in the gradual development of money seems to be the transition to digital currency. The massive popularity of private digital currencies and the fact that a lot of countries are in the research and testing stages of Central Bank Digital Currencies (CBDCs) tells that digital currency is not merely a short term trend, it is the future of currency as we know it today.

Most of the popular digital currencies today are based on blockchain technology which in simple terms is like a “large publicly available ledger” i.e. the history of transactions is available to all the users. This eliminates the role of any third party such as the government or the central bank, the decentralisation of authority is the biggest advantage as well as disadvantage of the unregulated digital currencies. While it provides greater transparency, accessibility and anonymity it also takes away the security that a centrally regulated and authorised currency offers. The absolute anonymity of digital currency transactions has to lead to cryptocurrencies like bitcoin gaining high popularity in illegal arenas like drug dealing and human trafficking.

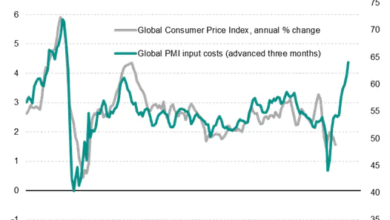

Source: Bank of England

It would be very unfair if to overcome these shortcomings the government decides to ban the use of any kind of digital currency. However, legitimising the use of cryptocurrency in its present form and allowing it to bypass the established formal monetary structure can lead to a great deal of instability and even full-blown economic crises. Therefore the solution that comes up is the digitisation of fiat currency. It provides the transparency and convenience of the digital currency along with the security and certainty of the central bank. A lot of central banks around the world are either into research or trial stages of CBDCs. Among the major economies, the Chinese are the frontrunners who have not only run successful pilot programmes but are also planning a full-fledged launch of its central bank digital currency called E-Yuan.

Source: Atlantic Council

It’s high time that the RBI to jumps on the bandwagon to ‘cash’ the early gains. The transition is now inevitable, and we should proceed towards it without any further ado. However, we do have our share of problems that would obstruct India’s transition to the digital rupee. In the recent past, we have made significant achievements in terms of improving the quantity and coverage of internet access but the quality is still an issue especially in remote areas. There is a severe lack of digital literacy and a resulting distrust towards any kind of ‘virtual assets among the general public. These shortcomings can be overcome by ensuring that the required attention is given to awareness and infrastructure development before any ‘masterstroke’ is performed.