The Story of India’s Current Account Surplus

Written by: Aahan Tulshan

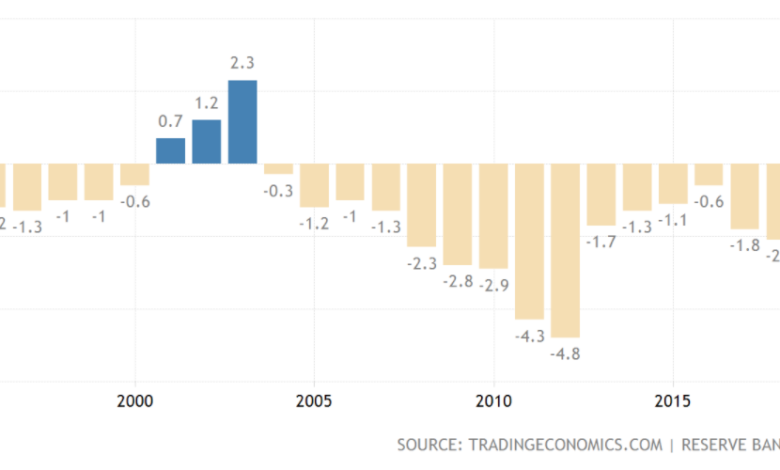

A country’s current account represents its relation with other nations in terms of exchange of goods, services, and other transfers like aid and payments to foreign investors. The foreign exchange receipts are credits and the payments are debits. A country records a current account surplus when the inflows exceed the outflows and a deficit when the opposite happens. India has run a current account deficit for most of its history, with imports exceeding exports most of the time.

India’s current account balance as a % of GDP

However, in the last couple of years, the tide has turned with India reporting a surplus in the fourth quarter of 2019-20 (after a gap of 13 years) which was fueled by a lower trade deficit and an increase in receipt of invisible. Then, in the first half of the fiscal year 2020-21, the country reported a surplus of 3.1% of GDP, which was led by a fall in merchandise imports and lower outflows for travel services.

While countries generally strive for current account surpluses, this surplus was concerning for a few reasons. The drivers for this surplus weren’t increased exports and increased foreign exchange inflows but decreased outflows. The imports fell by a greater margin than exports, which meant demand was contracting. India’s economic activity had taken a huge hit, which was largely due to the lockdown imposed by the Government, which was one of the strictest in the world. In addition to this, the Government stimulus was only around 2% of GDP, which was one of the lowest in the world. Japan legislated a stimulus of 20% of GDP while the US legislated an immediate stimulus of 10% of GDP which included one time cheques sent to adults and children and unemployment benefits as well.

It may seem counterintuitive, but there is a relation in economics that shows that a current account surplus is equal to the sum of private and Government savings. A surplus shows there are excess funds in an economy. While having a surplus of funds is a good thing, these funds need to eventually be invested in profitable projects to spur economic growth and development. When an economy is in a recession, it is investment and Government spending that revives it and helps it recover.

Thankfully, as the fiscal year draws to a close, the country has seen robust capital inflows, both FDI and FPI (they reached an all-time high of USD 586.1 billion as of Jan 8 2021), which has helped revive the economy and the markets. Further, there were calls for increased R&D expenditure before the budget. This is sorely needed in our country, particularly the research component. It is expected that India’s current account surplus will be around 2% of GDP by fiscal year-end.

India’s net FDI inflow as % of GDP. Source: World Bank.

India is still a developing country and needs to use its funds to spur growth and economic activity. The need for this is highlighted now, when the future of the pandemic remains uncertain, despite efforts like mass vaccination.

Source: EY