The Easy Part Of The Economic Recovery Might Be Over

Is the economy finally starting to rebound? Based on the headline numbers from the August jobs report, things sure look that way. The report shows that the economy added 1.4 million jobs in August, and the unemployment rate fell below 10 percent for the first time since March, to 8.4 percent — down 1.8 percentage points since July.

Good news, right? Well, when it comes to jobs reports in this pandemic, looks can be deceiving. The economy is certainly improving: The August report shows that the labor force participation rate increased a bit and millions more furloughed workers returned to their jobs.

But there are a bunch of clues in this month’s report that the growth we’re seeing now isn’t as robust as it looks, and that it probably isn’t sustainable without a dramatic change in public health conditions:

- A significant chunk of the jobs gained in August were added thanks to a once-in-a-decade phenomenon that has nothing to do with the current recession — a slew of temporary hiring for the U.S. Census.

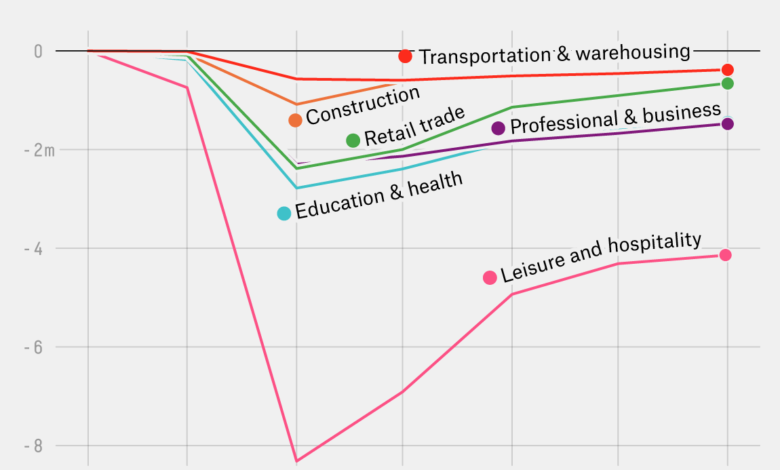

- Private-sector job growth is slowing overall, and the industries that were hit hardest by the pandemic — like leisure and hospitality — appear to be stalling out well below their pre-pandemic peak.

- Getting people back to work will likely be harder and harder in the coming months, because a growing share of unemployed people have lost their jobs permanently.

- The recovery is arriving faster for some groups than others — which means that workers of color, in particular, are still suffering much higher levels of unemployment than white workers.

Trump can thank the census for this month’s positive headlines

A lot of credit for this month’s better-than-expected jobs numbers should go to the U.S. Census Bureau. Every 10 years, the bureau goes on a hiring spree, bringing hundreds of thousands of workers onto its payroll to fan out across the country for a few months, knocking on the doors of people who haven’t returned their census forms to ensure the count is accurate. In a normal year, this sudden spate of hiring would be extremely noticeable — several hundred thousand new government jobs could increase that month’s total number of jobs gained by an order of magnitude.

But the COVID-19 recession has thrown our frame of reference out of whack. Because we lost tens of millions of jobs in March and April, it doesn’t seem weird that we’d be gaining well over a million jobs in a single month these days. So the addition of 238,000 Census jobs in August wasn’t as obvious as it ordinarily would be; instead, it’s quietly padding the total. But Census hires accounted for fully 17 percent of total nonfarm jobs added in August. And more importantly, this uptick is extremely temporary. Most Census workers will be laid off when canvassing for the count ends later this month.

The private sector is less of a success story

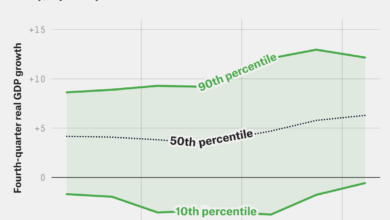

It’s also important to remember that we’re still very, very deep in the hole we fell into in April, and that job growth in the private sector is slowing. While government employment rose by 1.6 percent from July to August — again, fueled in large part by Census Bureau hiring — private-sector employment was up only 0.9 percent over the same period. After a similar 1.3 percent gain in July, this may signal that private hiring has hit something of a plateau. That’s corroborated by data from job-search websites such as Indeed, which also shows a slowing trend of job listings after steady gains earlier in the summer.

The job gains are slowing down fastest in industries that were hardest hit by the pandemic, which means it could be especially difficult for those industries to make it back to their pre-pandemic levels. For instance, the leisure and hospitality sector lost a staggering 8.3 million jobs in March and April, but after quick gains in May and June, the industry only added 621,000 jobs in July and 174,000 in August, leaving it 4.1 million shy of its pre-pandemic (February 2020) baseline:

And that’s true of essentially every major industry in America through late summer. Every economic supersector except mining and logging saw job gains in August, and all but a few made gains in June and July as well. Yet every one of them also employs fewer people now than it did in February. The closest to normal is utilities, which is down 1.3 percent from before the pandemic. But the median supersector is down 6 percent, with some industries (like leisure and hospitality) down as much as 25 percent from pre-pandemic levels.

Nick Bunker, the director of economic research for North America at the Indeed Hiring Lab, a research institute connected to the job-search site Indeed, told us that the slowdown in leisure and hospitality is especially concerning, because it could indicate that as long as it’s operating under pandemic conditions, the beleaguered industry could be running out of new jobs to add.

“For me, it’s about figuring out when we’ve moved out of the rebound stage into what looks more like a typical recovery from a recession, where there are steady gains but not a huge surge in employment,” he said. This month’s job numbers indicate that we could be reaching that point, which is quite alarming given how far below the pre-pandemic peak those industries still are.

A permanent problem

One thing economists feared earlier in the summer is coming to pass: The number of people who had permanently lost their jobs rose last month, even as lots of temporarily unemployed people were returning to work. According to the BLS, 9.2 million workers had been on temporary layoff in July, which was similar to the number from June (10.6 million). But only 6.2 million fell into that category in August, meaning 3.1 million furloughed or otherwise laid-off workers went back to work. That’s the good news. The bad news is that the number of people who had been permanently laid off did not see the same decline — that group actually grew from 2.9 million workers in July to 3.4 million in August.

On the one hand, 64 percent of people who lost their jobs were categorized as temporary layoffs, which is down dramatically from earlier in the pandemic (it was 90 percent in April) and is more in line with numbers from before the crisis; the share in February, for instance, was just 39 percent. But with unemployment still quite high by historical standards, this also means it will be increasingly hard for the people who are now permanently unemployed to find jobs. “We have a slow-moving unemployment crisis coming,” said Martha Gimbel, an economist with Schmidt Futures. “We saw this happen in the last recession — it took many people who lost jobs an incredibly long time to come back from that.”

The share of workers in part-time jobs is also increasing: In August, 17 percent of people with jobs worked part-time. In a way, this, too, is more in line with a “normal” economy; the share in February was 17.5 percent. But the reason so many more workers are taking part-time hours speaks to one of the biggest economic issues of the pandemic: child care. When the BLS lists workers by full- or part-time status, they also track whether that status is due to economic reasons — like a slowdown in that industry or a slack job market — or noneconomic reasons. Right now, 71 percent of all non-agricultural part-time workers fit the latter category, and one of the biggest noneconomic reasons that people look for or accept part-time work is child care obligations. We know that, even under normal circumstances, about one-third of women who have young children and work part-time do it because of caretaking duties. With in-person learning at school still curtailed in many areas, it makes sense that this would factor into an even greater rise in part-time work, simply out of necessity.

The recovery isn’t helping everyone equally

Meanwhile, the recovery continues to arrive more quickly for some people than for others. This month, the unemployment rate for white workers fell to 7.3 percent — down 1.9 points from July. But workers of color continue to struggle with much higher levels of unemployment. The unemployment rate was 13 percent for Black workers, 10.7 percent of Asian workers, and 10.5 percent for Hispanic workers.

The gap between Black and white workers is especially concerning. It’s unfortunately normal for the Black unemployment rate to be much higher than the unemployment rate for white workers — that was true earlier this year, when times were good, and it was also true during the Great Recession.

Since the current recession started, the black-white unemployment gap has actually been smaller than it was during the Great Recession, when Black unemployment peaked at a stunning 16.8 percent in March 2010, while white unemployment was much lower at 8.9 percent. But that’s in part because Black workers — particularly Black women — tend to be overrepresented in jobs that have been deemed essential during the COVID-19 pandemic, which meant they may have been insulated from some of the dramatic job losses in April and May.

As workers start to be rehired, though, both Bunker and Gimbel told us that they expect white workers to be called back more quickly, thanks to employers’ intentional and unintentional racial bias. “Black workers tend to be the first to be laid off and the last to be hired,” Bunker said. “Unfortunately this is a factor you see in lots of recoveries — it takes a very strong labor market market to get the Black unemployment rate down to levels that would be acceptable for other groups.”

For instance, this month, the unemployment rate for white women fell by 2.3 points, one of the largest drops of any demographic group.7 But for Black women, the decline was much narrower, only 1.3 points.

That disparity is troubling on a number of levels. It’s telling, first of all, that we’ve grown so accustomed to a high unemployment rate among Black workers that the current disparity isn’t all that surprising. And moral considerations aside, Gimbel said, unevenly distributed job gains can turn into a drag on the economy. Race-based job discrimination, whether it’s deliberate or not, means that the person who gets any given job may not be the most qualified person for that position. “Then you have to remember that those people are also consumers,” Gimbel said. “They spend money. So if they don’t have that money to spend, that holds us back too.”

All of this is a reminder that as the recovery continues, there will be a lot that the headline jobs numbers can’t tell us about how the recession is being experienced by different groups of people. Some industries are rebounding faster than others; some people are much likelier to benefit from the rallying economy than others. And if the recovery is indeed starting to slow down, those inequalities could be with us for a very long time.